P3 7-8/2020 en

Smithers

Online Shopping Among Top Disruptive Technologies Driving Change in Paper and Board Industry

Analysis

Paper and paperboard manufacturing is being impacted by online shopping and other global forces. This dominating change in consumer purchasing habits is creating opportunities for the packaging industry that is being supported by a variety of disruptive technologies. The industry is in the process of reacting to the top disruptive technologies, which Smithers has outlined in its new report Ten-Year Forecast of Disruptive Technologies in Paper and Board to 2030.

The paper and board industry is part of the global economy where new businesses and competing products and technologies are being introduced at a dazzling pace. For example, Big Data, artificial intelligence and robotics are increasingly being used by the industry. This new report from Smithers looks at the application and limitations of these technologies, and the need for cybersecurity to protect digital platforms. On top of this, legislation, tariffs, subsidies and climate change, and COVID-19 are all having an impact.

Global consumption of paper and board

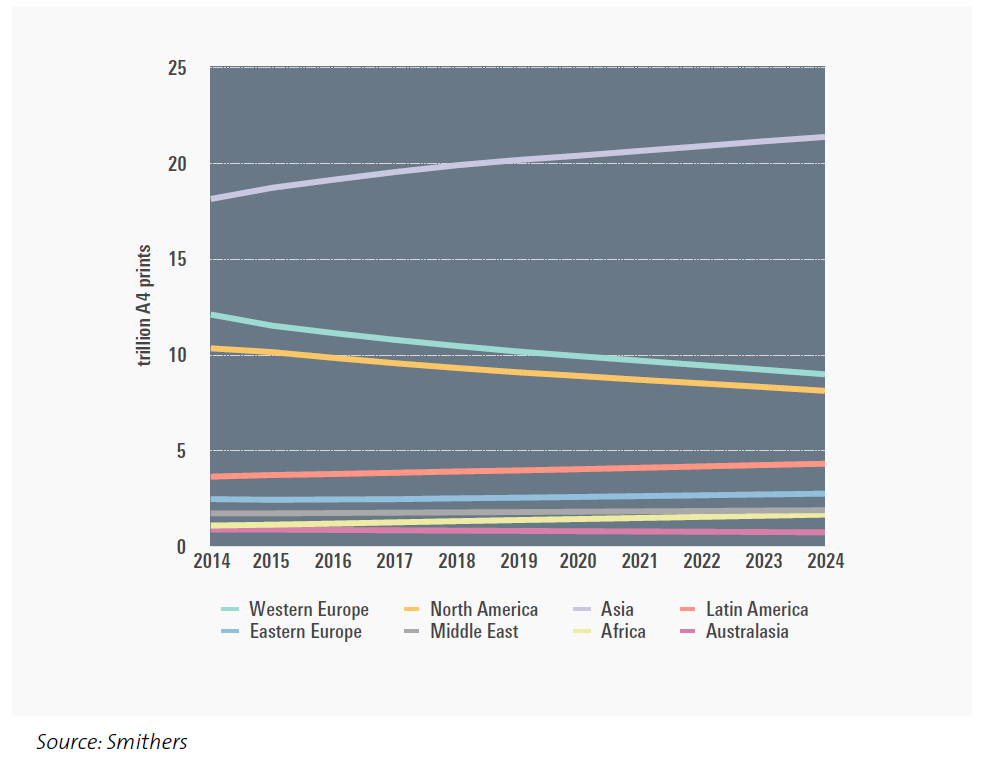

The increased demand for traditional paper and board is driven by population growth and greater urbanisation in China, India, Africa and Eastern Europe. Global printed paper volume reached 49.4 trillion A4 print equivalents in 2020 and is expected to plateau at this volume until 2024 (Smithers, The Future of Global Printing to 2024). Print volumes are falling in Western Europe (-2.5% CAGR) and North America (-2.3%), whereas they are growing in Latin America (1.7% CAGR), Asia (1.2% CAGR) and Africa (4.0% CAGR).

COVID-19

The world has been in the midst of the COVID-19 pandemic, which has changed the way we live. Online sales of packaged goods have increased. In North America alone, packaging demand increased by 8% during the month of April 2020. In contrast, several newspapers have gone out of business or have suffered financial hardship because of lack of advertising as society shut down. After the pandemic subsides, long term, demand for packaging will probably exceed historical averages by one or two percent, whereas newsprint will decline at a significantly greater rate than in the past.

Top 20 disruptive technologies

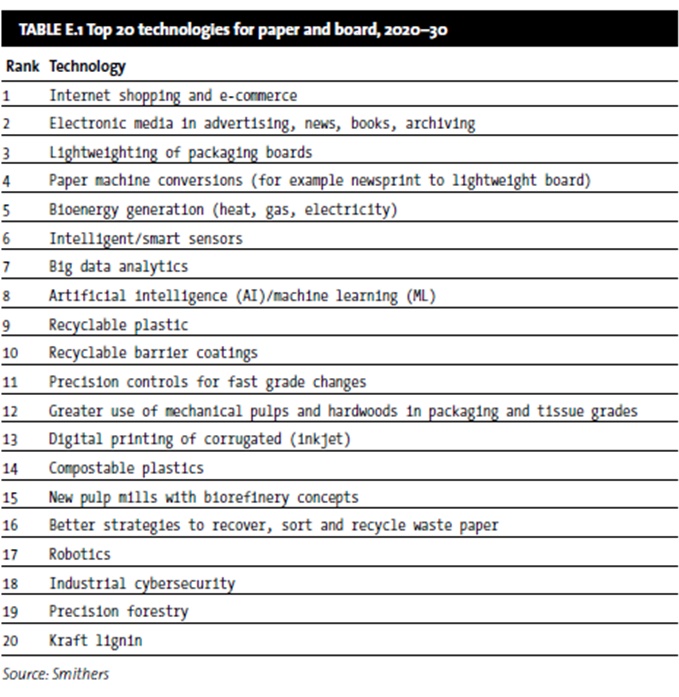

The top 20 disruptive technologies in paper and board covered in this new report from Smithers can be grouped into four general categories: Impact of the internet on consumer behaviour; digitisation of the paper and board industry; paper and board substitution for plastic; and internal transformation of the paper and board industry. The technologies with the highest likelihood of technical success have all been installed on a commercial scale to some extent, including internet shopping, electronic media, paper machine conversions, digital inkjet printing of corrugated, bioenergy generation, and lightweighting.

The internet

The internet, which has spawned e-commerce and electronic media, has had a major impact not only on the paper and board industry but on the way we work and live. Via the internet, we can now read the news and get information immediately, often for free. In the past, we sought merchandise or services by perusing classified ads in newspapers or advertisements in magazines. Now it is possible from the comfort of a computer keyboard or smartphone to search the entire world for something through platforms such as Amazon, Alibaba and eBay.

With the disappearance of advertising dollars, many newspapers in Europe and North America have folded, reduced print runs, or have moved to digital platforms. Magazines have also declined but may find a niche in luxury goods. In the US, the internet has surpassed television for advertising dollars, and e-books are now more popular than printed books.

As demonstration of the booming popularity of online shopping, a recent study in Australia found that more Aussies than ever are turning to the internet to purchase goods instead of heading in store. According to a new Finder report, 88% of respondents – equivalent to 17 million Australians – are doing their shopping online. In fact, Aussies are spending roughly 5.3 hours per week – around 36 working days a year – browsing the web for new things to buy. Men confessed to spending more time than women shopping online, with 5.7 hours per week compared to 4.9 hours per week. And Aussies are spending big, with an average of $188 a week, or $9,776 a year on online shopping – including online grocery shopping. As expected, the dramatic rise particularly over the past six months is a reaction to the COVID-19 lockdown.

Digitisation

Most technologies ranked in the top 20 are in the digitisation category. Pulp mills and paper and board machines are already highly instrumented and many functions are under computer control. Applications in the forest resource and harvesting, because of their complexities, are less advanced but are starting to enter the digital age. Key digital technologies include: Intelligent/smart sensors, Big data analytics, artificial intelligence (AI)/machine learning (ML); precision controls for fast grade changes; digital printing of corrugated (inkjet); robotics; cybersecurity; and precision forestry. An instrumented mill is awash in data and information, some of which is used in control loops and some is displayed for operators to monitor and to help guide their decisions.

Big data has the promise to mine and massage this avalanche of data into simpler and more useful forms using computing tools that have recently been developed.

Intelligent sensors, which have a microprocessor physically on the sensor, are part of the solution. The microprocessor can process raw signals, sometimes from multiple heads, and convert this into a physically meaningful result. Although no sensors are available to measure important product parameters online such as strength, soft sensors can calculate this by mathematically combining signals from a number of different sensors. Some sensors use artificial intelligence to learn and continuously update their parameters. Intelligence sensors are a key component in precision controls for fast grade changes.

Robots are using artificial intelligence for warehousing and sorting of recycled materials. The industry is at the beginning of the journey to apply artificial intelligence/machine learning to perform some functions that are now the responsibility of operators. However, digitisation has an Achilles heel. As companies become completely dependent on their digital platform, they are vulnerable to hackers, criminals and competitors who can steal their information and cripple their operations. This means that cybersecurity is a high priority.

Substitution for plastic

In the next decade, legislation will be in place in the US, Europe and China to ban single-use plastics and insist that most other plastic be recycled. Despite the fact that over half the paper and board in the US is recycled, less than 10% of plastics now are. Restrictions on plastics create a major opportunity for fibre-based products to fill the gap.

In response to these changes, the plastics industry is making major investments in technologies to recycle plastics, including the European Union’s “Horizon 2020” project. Compostable plastic is based on plant-based polymers such as polylactic acid (PLA), which is a sustainable raw material. If successful, these efforts will diminish paper’s advantages in recycling and thereby limit paper and board’s potential market share.

Currently though, board packaging is forecast to grow consumption. It can be split into three main categories: corrugated board, folding cartons, and liquid packaging board (LPB). Corrugated board packaging consumption is influenced by a range of factors, including urbanisation, growing disposable incomes in emerging economies, ageing and growing populations and smaller family units. Growing environmental concerns also benefit the corrugated board market due to perceived and real environmental benefits of cellulose-based packaging.

Folding carton demand is predicted to grow in four main end-use segments: more spending is expected on luxury items; the on-the-go eating trend will drive demand for retail carry-out cartons; a larger ageing population will increase demand in the pharmaceuticals category; while beverage carton demand is also expected to grow.

Liquid packaging board consumption is likely to be maintained over the forecast period by the healthy eating trend, together with growing consumption patterns in the emerging markets. A key trend for LPB producers is the growing use of renewable materials to enhance their environmental credentials.

It should be noted that most liquid containers, even if they are primarily composed of fibre, have polymer or foil barrier layers that cause difficulties and contamination when recycling. Recyclable barrier coatings will open up market share. Sort-at-source, digitising the collection and using robots with AI in the collection centres has shown that improvements are possible.

In recent news, packaging and paper manufacturer Mondi and BIOhof are replacing plastic wrap with a fully corrugated solution for fresh produce. Mondi has collaborated with BIOhof Kirchweidach, an organic farm in Bavaria, to design a sustainable packaging solution for 500g packs of tomatoes on the vine to be distributed to PENNY supermarkets, owned by major German retailer REWE Group.

Coral Tray fulfils BIOhof’s objective of replacing its previous packaging, which used 2.5 g of plastic film per pack, with a recyclable and plastic-free solution, supporting REWE Group’s sustainability goals. It’s called ‘Coral Tray’ because of its resemblance to undersea coral and contribution to reducing plastic waste, potentially helping to protect marine life. The new packaging is fully recyclable and made of renewable material and recycled corrugated board, which has an average recycling rate of over 80% in Europe.

Internal industry transformation

Transformation of the paper and board industry includes converting machines to make different and novel products, and reducing fibre costs. This includes disruptive technologies: Lightweighting of packaging boards; Paper machine conversions; Bioenergy generation; Greater use of mechanical pulps and hardwoods; New pulp mills with biorefinery concepts; and Kraft lignin.

In response to the decline in printing and writing papers, paper machine conversions from newsprint to lightweight linerboard are common. Because the production of one converted newsprint machine equals the average yearly global increase in linerboard demand, there could be an oversupply in this market.

This coming decade is the dawn of the biorefinery concept. There are now several plants making by-products such as electricity, methane, methanol, biodiesel and lignin. Major investments have been made to produce cellulose derivatives such as cellulose fibrils (CF), microfibrillated cellulose (MFC) and CNC (cellulose nanocrystals). Most of these products are for internal mill use, but partnerships are developing outside markets for these materials.

In other developments, use of cellulose derivatives such as CF and MFC could allow a step change in lightweighting and permit greater use of hardwoods and mechanical pulps in some products.

About the report

The Ten-Year Forecast of Disruptive Technologies in Paper and Board to 2030 provides comprehensive analysis of the market and technological drivers behind the ongoing expansion of this sector. Research included in the report using a combination of primary and secondary research, including interviews and technology evaluations with industry experts across the globe.

Exclusive report content includes an authoritative listing of the top 20 disruptive technologies that will impact the paper and board industry across 2020-30; in-depth technology profiles outlining routes to market the commercial impact; and a comprehensive examination of the key trends and drivers that will shape the future of paperboard supply and use.

To download a brochure on the Ten-Year Forecast of Disruptive Technologies in Paper and Board to 2030, please visit the website here.